[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”4.16″ global_colors_info=”{}”][et_pb_row admin_label=”row” _builder_version=”4.16″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_text admin_label=”Text” _builder_version=”4.16″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}”]

If you’re thinking of getting a VA home loan, you’ve got to read this. The coronavirus pandemic has caused home sales to soar despite the increase in home sales prices in some parts of the country.

And we see the impacts on VA mortgage financing, too.

Here’s why:

Interest rates are at historic lows…

Banks are changing procedures…

Lenders are busier than ever…

Added together, it makes a difference in how you apply for and secure a VA mortgage.

Here at the Wendy Thompson Lending Team, we love to help our veterans. After all, who better deserves to achieve the American dream than someone who served our country?

For more about how COVID-19 has affected your chances to get a VA mortgage, keep reading.

Interest Rates have Fallen

COVID-19 disrupted a wide range of industries in 2020, including banking and mortgages.

As a result, interest rates started falling in the early months of 2020.

Why did COVID-19 cause rates to fall?

Great question.

It started when the Federal Reserve lowered the target range of interest rates for federal funds to 0%-0.25% in March 2020 in an effort to stabilize the economy.

Now, to clarify, the Federal Reserve doesn’t set mortgage rates.

But…

The rate they set can have a huge impact on borrowing costs, which is why interest rates fell so quickly.

Just how much did they drop?

The average interest rate for a 30-year fixed-rate mortgage was 3.95% over the decade from December 2010 to November 2020, according to Federal Reserve Economic Data.But in December 2020, the average rate fell to 2.71% – a difference of nearly 1.25%!

The drop from 3.95% to 2.71% can mean even bigger savings for VA mortgages. That can translate into thousands of dollars saved in interest over the life of a mortgage.

On a $220,000 house, that’s nearly $55,000 in borrowing costs that you don’t have to pay for your 30-year mortgage!

Learn More – Veterans Who Don’t Shop Around Pay Higher VA Mortgage Rates!

Mortgages are Harder to Get

Buying a home is rarely stress-free. There’s always another form or document or inspection that needs your attention.

The right lender – one that knows VA home loans inside and out – can make becoming a homeowner easier…

…but COVID-19 has caused a few roadblocks.

Thanks to the pandemic, there are new factors standing between you and your VA home loan:

- Lenders tightened minimum borrowing standards

- More lending applications have slowed down the process

- Fewer small mortgages vs. larger mortgage loans are available

CHECK EXACT VA RATES

Minimum Borrowing Standards

Some lenders changed their borrowing standards, making it harder to qualify. For instance, many lenders now require a 640 minimum credit score for a VA home loan.Before the pandemic? You might have been able to quality with a score as low as 600-620.But it depends on the lender because the VA loan does not have a standard minimum credit score.It’s up to individual lenders to set credit score requirements.

Influx of VA Loan Applications

With falling interest rates, more and more people are pursuing the path to homeownership.And you know what that means?Mortgage lenders are busier than ever. The increase in VA loan applications have created a backlog and slowed down the process.

Small Home Loans are Disappearing

The Pew Charitable Trust identified another potential roadblock: the number of mortgages for amounts below $150,000 fell between 2009 and 2018:

- Lenders tightened minimum borrowing standards

- More lending applications have slowed down the process

- Fewer small mortgages vs. larger mortgage loans are available

But here’s the thing:If you’re borrowing above $150,000 – you probably don’t have anything to worry about.That’s because mortgages above that amount have increased by 65%!Now, that applies to more than just VA home loans – it factors in conventional and FDA loans, too.Still… if you’re shopping for a VA home loan, keep in mind that COVID-19 can make your mortgage process look a little different than in the past.

Discount Points are on Sale

One of the biggest expenses you pay with a mortgage is in the form of interest. Higher interest rates mean higher monthly payments and more money out of your pocket.However, discount points, or mortgage points, are a common way to reduce your VA loan borrowing costs.You purchase discount points in exchange for the lender lowering your interest rate. Sounds like a great deal, right?Well, it depends.To buy one point, you need to pay 1% of your loan amount. For example, if you’re borrowing $220,000 with a VA loan and pay for one point to lower your rate, it’ll cost you $2,200.Usually, purchasing one point can take 0.25% off your rate for a 30-year fixed-rate mortgage.But thanks to COVID-19, the discount points can go even further than before.You could lower your rate up to a full percentage point by purchasing just one point!And that can save you a significant amount of cash.Although, with rates as low as they are now, it might not make sense to buy points. The decision ultimately comes down to simple math.Use our mortgage calculator or ask your lender to run the numbers to see how discount points can lower your home-buying costs.

Sample VA loan Rates by Credit score

| Fico score | APR | |

|---|---|---|

| 700 | 3.625 % | |

| 660 | 3.75 % | |

| 640 | 3.75 % | |

| 620 | 4.125 % | |

*Updated 2/16/22 – Rates are based on a $250,000 loan with a 0% down payment. Rates change often and differ based on your state, down payment, and loan amount.

Keep in mind that rates constantly change so it is best to contact us directly for the correct rate.

What If You Want a VA Refinance Loan?

Rock-bottom interest rates can make refinancing an attractive option.And you know what?VA home loans have two options if you want to refinance your home:

- VA streamline refinance (VA IRRRL)

- VA cash-out refinance

But refinancing got more expensive thanks to the pandemic.How much more?…0.5% more.The Federal Housing Finance Agency (FHFA) rolled out an Adverse Market Refinance Fee. Basically, it’s a fee to recoup losses from the market downturn.But there’s good news…You’re exempt from this fee if you’re refinancing less than $125,000, according to the FHFA.But for a $220,000 refinance?You’ll end up paying an extra $1,100 in closing costs to cover the fee.

VA Mortgages and COVID-19: Your Next Steps

The pandemic has made some waves when it comes to getting a VA mortgage.

But don’t let those obstacles get in the way of your dream home. You can still buy a house with a VA home loan during the pandemic.

And we’re here to help.

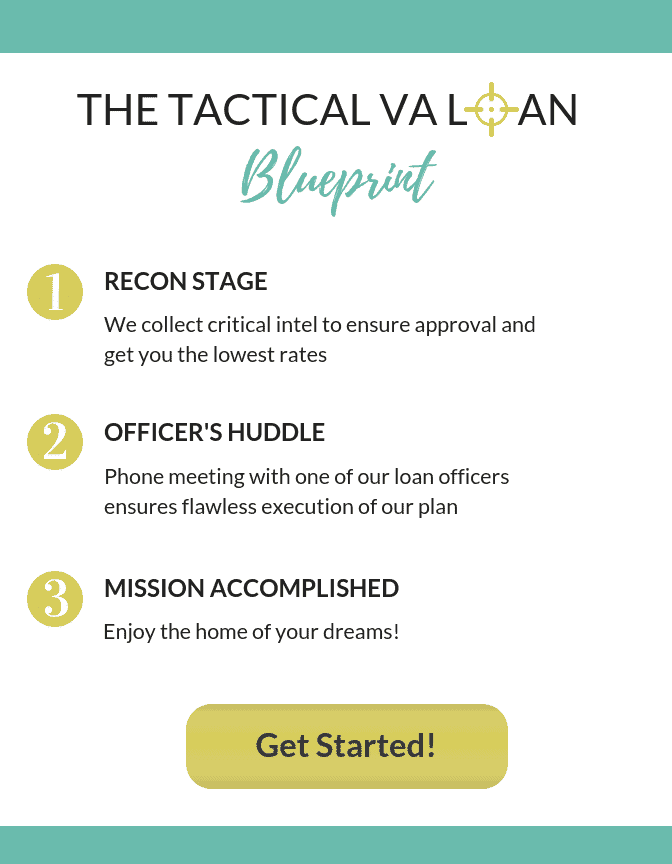

The Wendy Thompson Lending Team is a top-ranked VA Loan and Mortgage specialist, and we work with active military, veterans and eligible family members to help secure a VA loan in all 50 states.

Deciding on the right VA lender is the most important decision you will make. Choosing the wrong lender can result in you losing your dream home or costing you hundreds of thousands of dollars in more interest over the life of your mortgage.

Don’t make that mistake, contact the Wendy Thompson Lending Team today!

You can start the process by clicking the yellow ‘See if I’m Eligible’ button on the right side bar under the ‘Start your quote for a Home Loan’ or call Wendy’s Team directly at (901) 250-2294, to get started on living the American Dream in the home of your Dreams!

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]