It’s very common for first time home buyers to have no idea how much they can afford to pay for a home.

We are going to pull back the curtain on the best VA loan rates for $200,000, $225,000, $250,000 and $275,000 mortgages.

You need to know the VA loan amount that you can afford and the key factors that determine that number.

We will review those components and explain how your credit score affects your APR interest rate, show how the APR determines your monthly mortgage payment which is a huge factor in the amount of a mortgage you will qualify for.

Be sure that you check your VA Loan Eligibility.

UNDERSTANDING HOW TO OBTAIN THE BEST VA HOME LOAN RATES FOR A MORTGAGE

We have laid out multiple charts below to help you determine the best VA loan rates for multiple mortgages you may qualify for.

The bottom line is the best VA loan rates are going to be based on your credit score.

Each chart has three tabs at the top with a mortgage amount on it, such as $200,000, $225,000, $250,000 and $275,000.

Below you will find credit score ranges, APR percentages and the monthly cost for that mortgage based on your credit score.

To get the best VA loan rates you will have to have a high credit score in the 750, 775 and even 800 range to you receive the better APR interest rates.

You can look at the chart and see what your monthly VA mortgage payment would be based on the loan amount.

The Wendy Thompson lending team will determine the amount you can afford, largely based on your debt to income ratio.

Most VA mortgage brokers will want your debt to income ratio to be between 30 and 40 percent of your monthly income.

For instance, if you make $5,000 a month, a VA home loan lender will likely qualify you for a monthly mortgage payment of 30%-40% of your monthly income.

There are multiple factors that go into determining the best VA rates for a mortgage and checking with the Wendy Thompson Lending Team is the place to start.

Best VA Loan Rates For A $200,000 To $220,000 Mortgage

Whether you qualify for a $200,000, $210,000 or $220,000 VA home loan, a major factor to get the best VA loan rates is your credit score.

If you have a lower credit score in the 620, 630, or 640 range, one quick way to possibly increase your credit score is to ask your credit card companies to increase your limits.

This will hopefully increase your available unused credit which will lower your used credit available percentage without ever having to pay down your credit cards.

By raising your credit score only 20 points on a $210,000 mortgage from 640 to 660 could save as much as $56 a month for 30 years

Saving $56 dollars a month is over $20,000 extra dollars in your pocket over the life of a 30 year VA home loan.

As your credit score gets higher the APR rate savings diminish, such as a credit score of 700, 725 or 750 for a $220,000 VA home loan may have a monthly payment of around $1,147.00.

However, a credit score of 775, 800 or 825 for the same VA mortgage has an estimated payment of $1,118.00 a month which $29 less than someone with a credit score in the lower 700’s.

- $200,000

- $210,000

- $220,000

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,016.00 |

700 – 759 | 2.75 % | $1,043.00 |

680 – 699 | 2.75 % | $1064.00 |

660 – 679 | 2.875 % | $1,090.00 |

640 – 659 | 3.0 % | $1,144.00 |

620 – 639 | 3.25 % | N/A |

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,080.00 |

700 – 759 | 2.75 % | $1,095.00 |

680 – 699 | 2.75 % | $1,117.00 |

660 – 679 | 2.875 % | $1,145.00 |

640 – 659 | 3.0 % | $1,201.00 |

620 – 639 | 3.25 % | N/A |

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,118.00 |

700 – 759 | 2.75 % | $1,147.00 |

680 – 699 | 2.75 % | $1,170.00 |

660 – 679 | 2.875 % | $1,199.00 |

640 – 659 | 3.0 % | $1,258.00 |

620 – 639 | 3.25 % | N/A |

*Updated 6/1/2021 – Rates are based on a loan with no down payment over 30 years. Rates change often and differ based on your state, down payment, and loan amount.

Best VA Loan Rates For A $225,000 To $245,000 Mortgage

Let’s take a look at the chart below for a $245,000 VA loan.

The difference in monthly payments for someone with a credit score of 775 or 825 and someone with a credit score of 620 or 635 is $241 a month for the exact mortgage amount.

Even if you were looking to borrow $235,000 for a new home, if you have a credit score of 760 or 800, compared to someone with a credit score of 625 or 639, you will pay $232 less a month than the person with a lower credit score.

Learn More – Veterans Who Don’t Shop Around Pay Higher VA Mortgage Rates!

When you are looking to purchase a house you don’t want to inadvertently lower your credit score.

Did you know that applying for new credit cards CAN sometimes lower your credit score?

Check with the Wendy Thompson lending team to help get you the best VA loan rates.

- $225,000

- $235,000

- $245,000

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,143.00 |

700 – 759 | 2.75 % | $1,173.00 |

680 – 699 | 2.75 % | $1,197.00 |

660 – 679 | 2.875 % | $1,226.00 |

640 – 659 | 3.0 % | $1,287.00 |

620 – 639 | 3.25 % | N/A |

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,194.00 |

700 – 759 | 2.75 % | $1,225.00 |

680 – 699 | 2.75 % | $1,250.00 |

660 – 679 | 2.875 % | $1,281.00 |

640 – 659 | 3.0 % | $1,344.00 |

620 – 639 | 3.25 % | N/A |

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,,245.00 |

700 – 759 | 2.75 % | $1,277.00 |

680 – 699 | 2.75 % | $1,303.00 |

660 – 679 | 2.875 % | $1,336.00 |

640 – 659 | 3.0 % | $1,401.00 |

620 – 639 | 3.25 % | N/A |

*Updated 6/1/2021 – Rates are based on a loan with no down payment over 30 years. Rates change often and differ based on your state, down payment, and loan amount.

Best VA Loan Rates For A $250,000 To $270,000 Mortgage

If we look at VA home loans for $250,000, $260,000 or $270,000 the gap in payments between higher credit scores and lower credit scores only increases.

Again, even looking at a more average credit score of 680, 690 or 698 for a $250,000 mortgage compared to someone with a credit score of 660, 675 or 677 could save $33 extra a month over 30 years.

Before you qualify for a $260,000 home loan, you should check your credit reports, you can get a free copy of the three credit reporting agencies at AnnualCreditReport.com.

If you find any information that is incorrect, you are legally allowed to dispute those mistakes which could increase your credit score.

The Wendy Thompson lending team can help you every step of the way.

- $250,000

- $260,000

- $270,000

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,270.00 |

700 – 759 | 2.75 % | $1,303.00 |

680 – 699 | 2.75 % | $1,330.00 |

660 – 679 | 2.875 % | $1,363.00 |

640 – 659 | 3.0 % | $1,430.00 |

620 – 639 | 3.25 % | N/A |

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,321.00 |

700 – 759 | 2.75 % | $1,355.00 |

680 – 699 | 2.75 % | $1,383.00 |

660 – 679 | 2.875 % | $1,417.00 |

640 – 659 | 3.0 % | $1,487.00 |

620 – 639 | 3.25 % | N/A |

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,372.00 |

700 – 759 | 2.75 % | $1,407.00 |

680 – 699 | 2.75 % | $1,436.00 |

660 – 679 | 2.875 % | $1,472.00 |

640 – 659 | 3.0 % | $1,544.00 |

620 – 639 | 3.25 % | N/A |

*Updated 6/1/2021 – Rates are based on a loan with no down payment over 30 years. Rates change often and differ based on your state, down payment, and loan amount.

Best VA Loan Rates For A $275,000 To $295,000 Mortgage

As we look at the larger VA loan rates for $275,000, $285,000 and $295,000 mortgages, we see even a higher gap in monthly payments between the better credit scores and the lower ones.

Because of the tremendous savings you can receive from increasing your credit score even a few points from 620, 625 or 634 to say 640, a detailed review of your credit situation is necessary.

The Wendy Thompson lending team will evaluate your credit history and debt to income ratio to help you get the best VA loan rates for $275,000, $285,000 and $295,000 mortgages.

- $275,000

- $285,000

- $295,000

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,397.00 |

700 – 759 | 2.75 % | $1,434.00 |

680 – 699 | 2.75 % | $1,463.00 |

660 – 679 | 2.875 % | $1,499.00 |

640 – 659 | 3.0 % | $1,573.00 |

620 – 639 | 3.25 % | N/A |

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,448.00 |

700 – 759 | 2.75 % | $1,486.00 |

680 – 699 | 2.75 % | $1,516.00 |

660 – 679 | 2.875 % | $1,554.00 |

640 – 659 | 3.0 % | $1,630.00 |

620 – 639 | 3.25 % | N/A |

| CREDIT score | APR | Mo. Payment |

|---|---|---|

760 – 850 | 2.75 % | $1,499.00 |

700 – 759 | 2.75 % | $1,538.00 |

680 – 699 | 2.75 % | $1,569.00 |

660 – 679 | 2.875 % | $1,608.00 |

640 – 659 | 3.0 % | $1,687.00 |

620 – 639 | 3.25 % | N/A |

*Updated 6/1/2021 – Rates are based on a loan with no down payment over 30 years. Rates change often and differ based on your state, down payment, and loan amount.

Lending or Borrowing – Which Is Right for You?

Deciding whether to be a lender or borrower depends on your money goals, risk comfort, and current situation. Let’s explore when being a lender might make sense:

- 1. Steady Income and Protecting Your Money:

If you’ve got a regular income and want to keep your money safe, being a lender could be a good call. Lending, like investing in bonds or savings, can give you steady interest income with less risk.

- Avoiding Risks:

Lenders usually face fewer surprises and lower risks than borrowers. If you’re careful with money and want to dodge the uncertainties of borrowing, lending might suit you.

- Earning Without Effort:

Lending can bring in money without you having to run a business or handle rental properties. It’s perfect for extra income without the extra work.

- Mix It Up:

Adding lending to your investments can spread out the risks. By lending in different ways, you can balance things out and aim for steady returns.

- Bonds and Savings:

Lots of folks choose bonds, savings, or CDs. These are like lending money to governments or banks for interest. They’re usually less risky than other investments.

- Call the Shots:

Lenders often get to decide how loans work. You can set things up to match your money goals just right.

- Managing Risks:

Lenders can use tricks like asking for something valuable as insurance or checking people’s credit. These tricks lower the chances of folks not paying back.

Remember, both lending and borrowing are important in money matters. Your pick depends on what you need and want. Some folks borrow to invest or start a business, while others lend for steady income and keeping their money safe. Many people switch between lending and borrowing as their money plans change.

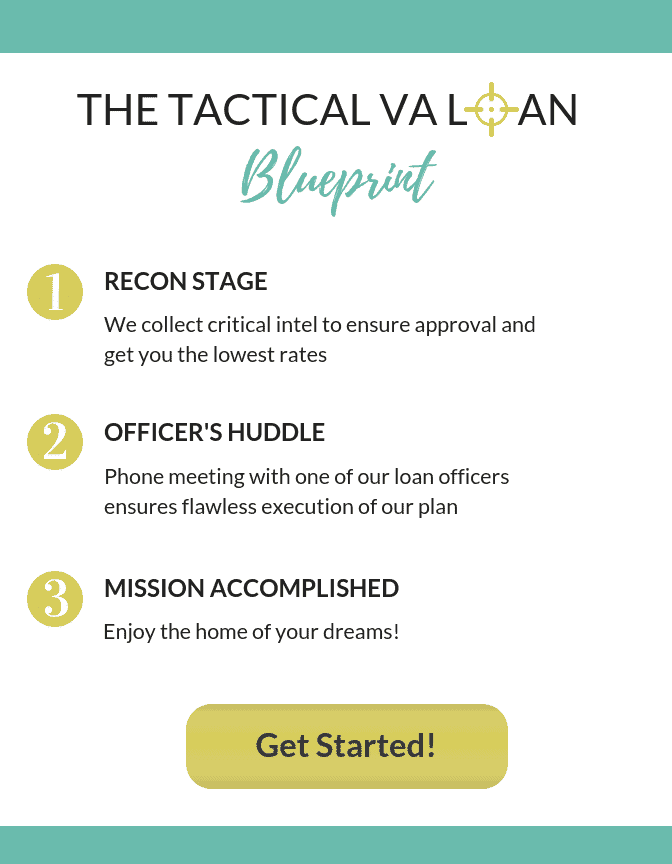

approval is easy with our “tactical va loan blueprint”

If you’re a current or retired military member looking to buy a home and choose to take advantage of the VA Loan program, you may be wondering the best mortgage company to go with.

Be very careful here as any mortgage company can offer a VA loan, but few of them specialize in VA loans, and there are a lot of ways lenders can screw up your dream of owning a home.

The Wendy Thompson Lending Team is one of the top ranked VA Loan and Mortgage specialist working with active military and veterans in all of the 50 States.

Unique only to the Wendy Thompson Lending Team is our easy 3 step plan:

Deciding on the right VA lender is the most important decision you will make. Choosing the wrong lender can result in you losing your dream home or costing you hundreds of thousands of dollars in more interest over the life of your mortgage.

Don’t make that mistake, contact the Wendy Thompson Lending Team today!

You can start the process by clicking the yellow ‘See if I’m Eligible’ button on the right side bar under the ‘Start your quote for VA Home Loan’ or call Wendy’s Team directly at (901) 250-2294, to get started on living the American Dream in the home of your Dreams!

Are you a veteran or active-duty service member looking for the best VA loan rates? Look no further.

VA loans offer incredible benefits, including no down payment and competitive interest rates. But finding the best VA loan rates can be challenging. Our experts are dedicated to helping you navigate the process and secure the best possible terms.