*Please note that effective April 3, 2020, we are no longer able to accept loans from applicants with a credit score below 640. Please visit our friends at My Credit Guy for help improving your credit score.

Buying a house is both exciting and frustrating.

Figuring out the VA loan requirements is key to sailing through the lending process and getting into your new home.

How can you do it?

Well, it isn’t magic.

All VA lenders have the same rules for VA loan eligibility.

Here at the Wendy Thompson Lending Team, we love VA loans because they’re designed to help Vets.

Is there anyone more deserving of this type of loan?

We don’t think so.

Let’s dive into the VA loan requirements and get you into a new home!

VA LOAN REQUIREMENTS

VA loans are an attractive option for Vets and their families. A VA loan can get you into a home with:

- – Zero down payment

- – A higher debt-to-income ratio

- – No mortgage insurance (PMI)

- – Lower income requirements

As you can see, the loans have a lot of benefits.

But there are a few hoops to jump through.

Even though the Department of Veterans Affairs guarantees the loans, you must apply and be approved by a private lender.

First, there’s a service requirement. And the guidelines depend on when you served.

Spouses can also take out a VA loan in certain circumstances.

Second, the property you want to purchase must meet safety standards and be up to date on building codes.

Then there’s the issue of meeting the lender’s requirements.

We’ll talk more about that in a minute.

Finally, there’s the funding fee. Your funding fee can range from 1.40% to 3.60% of the loan amount.

But don’t sweat it.

If you don’t have the cash to pay the funding fee upfront, your lender can add it to your total loan amount.

VA LOAN INCOME REQUIREMENTS

You need sufficient income to get approved for a VA mortgage. The VA doesn’t set a limit.

Instead, the Department of Veterans Affairs leaves it up to the lender.

Overall, VA loans have lower income requirements than conventional home loans.

Your income must be enough to cover:

- – The mortgage payment

- – Other shelter expenses

- – Your debts and obligations

- – Family living expenses

The VA requires lenders to verify at least two years of stable employment. If you don’t meet this requirement, you could still qualify for a loan if the lender explains why employment couldn’t be verified.

Again, it depends on the lender.

That’s why it’s essential to work with the right lender for your situation.

WHAT CREDIT SCORE DO YOU NEED?

The VA doesn’t have specific credit score requirements to qualify for a loan.

Like income requirements, the VA puts the lender in charge of the minimum credit score.

But there’s still a general guideline.

Most lenders require a credit score that’s around 600.

Of course, the higher your score, the better your interest rate. That’s why we like to see borrowers have a score in the 640 range.

But some lenders have more precise limits.

For instance, a lender can deny you based on the number of credit accounts you have or how many late payments show up on your credit report.

The trick to getting approved is to pick the best lender.

Learn More – Veterans Who Don’t Shop Around Pay Higher VA Mortgage Rates!

And that might be different based on your situation. What worked for your uncle or cousin may not be a good fit for you.

But here’s the thing.

Knowing which lender to go with can increase your chances of being approved for a VA loan.

And that’s where the Wendy Thompson Lending Team comes in.

More on that in a minute.

First, let’s see what documents you need.

GATHER THE RIGHT DOCUMENTS

When applying for any type of loan, lenders can require a lot of documentation.

Digging around for the right papers and forms is sometimes the hardest part!

If you know what to expect beforehand, you can be prepared

The very first thing you need is a Certificate of Eligibility (COE).

I can hear you now:

How do I get a Certificate of Eligibility?

You have two options:

- 1. Apply for your COE online through the eBenefits website

- 2. Apply through your lender with the Veterans information Portal

Besides your COE, VA loans require a service record. The document you need depends on your type of service, but could include a:

- – DD Form 214

- – Signed current statement of service

- – NGB Form 22 and NGB Form 23

- – Copy of your latest annual retirement points statement

- – Evidence of honorable service.

You may also need copies of pay stubs, W-2 forms, federal tax returns, bank statements, and a divorce decree or child care statement.

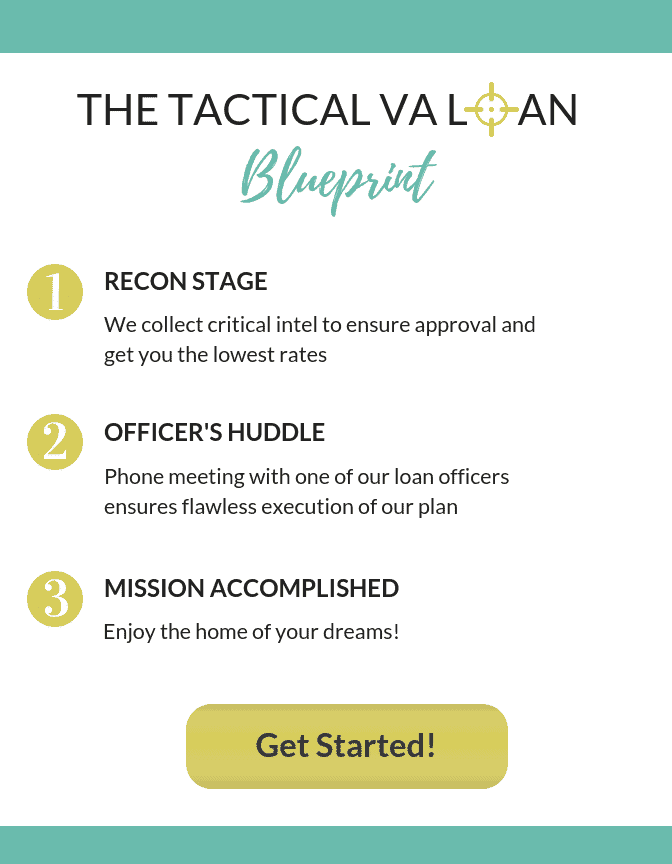

READY TO APPLY FOR A VA LOAN?

Your home-buying experience doesn’t have to be stressful.

The secret is to find a knowledgeable lender who can walk you through it.

The wrong lender can cost you hundreds of thousands of dollars in increased interest payments over the life of your loan.

Or worse!

You could miss out on your dream home altogether!

The Wendy Thompson Lending Team is a top-ranked VA Loan and Mortgage Specialist.

If you’re looking to buy a home and want to take advantage of the VA loan program, you’re in the right place.

We’re committed to working with active service members and military veterans in every state.

Ready to get started?

Contact the Wendy Thompson Lending Team today!

Deciding on the right VA lender is the most important decision you will make. Choosing the wrong lender can result in you losing your dream home or costing you hundreds of thousands of dollars in more interest over the life of your mortgage.

Don’t make that mistake, contact the Wendy Thompson Lending Team today!

You can start the process by clicking the yellow ‘See if I’m Eligible’ button on the right side bar under the ‘Start your quote for a Home Loan’ or call Wendy’s Team directly at (901) 250-2294, to get started on living the American Dream in the home of your Dreams!