#1 Johnson City Mortgage Lender

The Top Rated Mortgage Company in Johnson City, TN

Are you searching for a mortgage in Johnson City, TN? We have the best mortgage options for financing your next home!

Table of Contents

Your Johnson City Mortgage Broker

In Johnson City, Tennessee, a city known for its natural beauty, vibrant community, and rich history, The Wendy Thompson Lending Team is ready to assist you with your mortgage needs.

Whether you’re looking to buy a home amidst the picturesque landscapes of the Appalachian Mountains, upgrade to a larger property, or considering refinancing options, our team offers expert advice and personalized service to navigate Johnson City’s diverse real estate market.

Our commitment is to understand the specifics of Johnson City’s housing market and align our mortgage solutions with your personal home buying goals, ensuring a tailored and seamless process in this dynamic city.

Current Johnson City Mortgage Rates

The mortgage rates displayed on this website are for informational purposes only and are subject to change at any time without notice. Rates can vary based on various factors, including but not limited to, your creditworthiness, the loan-to-value ratio, and current market conditions.The displayed rates do not constitute a commitment to lend. To obtain an accurate and up-to-date mortgage rate quote, please contact The Wendy Thompson Lending Team directly. Our team of mortgage experts will provide you with personalized rates and terms based on your specific financial situation and loan requirements.

Types of Johnson City Home Loans

The Wendy Thompson Lending Team offers a wide range of mortgage options to meet the varied needs of Johnson City homebuyers:

Fixed-Rate Mortgages: Ideal for buyers seeking stable monthly payments, these loans have a fixed interest rate throughout the loan term.

Adjustable-Rate Mortgages (ARMs): Suitable for those planning shorter stays or expecting future financial changes, ARMs offer lower initial rates that adjust over time.

FHA Loans: A great choice for first-time buyers, featuring lower down payments and more flexible credit requirements.

VA Loans: Tailored for veterans and active-duty military members, these loans offer significant benefits like no down payment and no private mortgage insurance.

USDA Loans: For homebuyers looking in certain eligible rural or suburban areas, often with no down payment required.

Conventional Loans: These loans are not government-insured and offer various down payment and credit score options.

Jumbo Loans: For financing higher-priced properties in Johnson City, jumbo loans provide larger loan amounts beyond conventional limits.

Refinance Options: Refinancing can offer advantages like lowering your interest rate, changing loan terms, or accessing home equity.

Get A Johnson City Mortgage

Pre-Approval

Securing a mortgage pre-approval is a crucial first step in buying a home in Johnson City. The Wendy Thompson Lending Team ensures a smooth process:

Begin by organizing your financial details, including pay stubs, tax returns, employment history, assets, credit report, and current debts.

Choose a lender with in-depth knowledge of the Johnson City market. Our team provides expert advice and support tailored to your home-buying journey.

Completing this application gives a clear picture of your financial status and borrowing capacity.

A credit check is conducted to evaluate your financial health and determine suitable loan terms.

This document indicates your potential borrowing power, strengthening your position in Johnson City’s real estate market.

With pre-approval, confidently explore Johnson City’s housing market, focusing on homes that match your financial capabilities.

Get All Your Questions Answered And

Know Exactly How Much You Can Be Approved For

#1 Rated Johnson City Mortgage Broker

Choose The Best Johnson City Mortgage Lender

Selecting the right mortgage lender in Johnson City is key to a successful home-buying experience. The Wendy Thompson Lending Team offers several key advantages:

Local Market Expertise: Our extensive knowledge of Johnson City’s housing market ensures you receive the most effective mortgage advice and options.

Diverse Mortgage Options: We cater to the varied needs of Johnson City homebuyers with a broad selection of mortgage types.

Personalized Customer Service: Our commitment to personalized service ensures a mortgage process specifically tailored to your situation.

Clear Communication: We maintain open communication throughout your mortgage journey, providing clarity and confidence.

Commitment to Client Satisfaction: Our primary goal is to ensure a smooth and positive home-buying experience in Johnson City.

Discover Johnson City, Tennessee

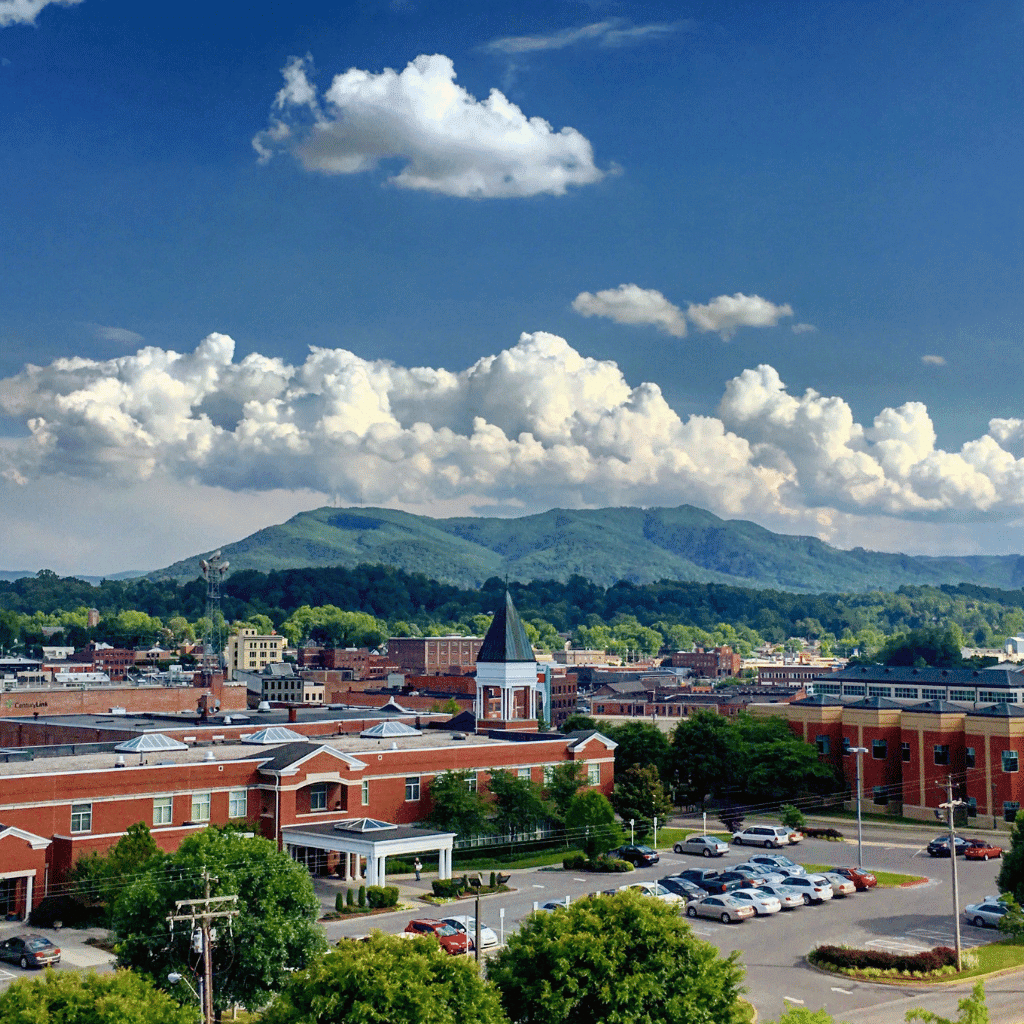

Johnson City, set against the backdrop of the Appalachian Mountains, offers a unique blend of natural beauty, cultural richness, and urban convenience. Known for its outdoor recreational opportunities, Johnson City provides residents with access to numerous parks, trails, and natural attractions.

The city boasts a vibrant downtown area with a growing arts scene, diverse dining options, and a variety of shops. Johnson City’s strong community spirit, combined with its affordable living and scenic surroundings, makes it an appealing destination for families, professionals, and retirees alike.

Johnson City Mortgage Reviews

FAQ's

Johnson City Mortgage FAQs

Johnson City’s housing market is characterized by steady growth, with increasing demand for homes in both urban and suburban areas. The market offers a range of affordable housing options, attracting both first-time and experienced buyers.

Property values in Johnson City are generally more affordable compared to larger Tennessee cities like Nashville or Memphis. The city offers good value, especially considering its amenities, quality of life, and scenic location.

Buyers should consider factors like proximity to employment centers, educational institutions, and outdoor recreational opportunities. The city’s economic growth and quality of life make it an attractive location for long-term investment.

Johnson City is experiencing new residential and commercial development, particularly in areas with easy access to the city center and major highways. These developments are enhancing the city’s appeal and providing additional options for homebuyers.