Like BBQ. Or pizza. Or mortgage loans.

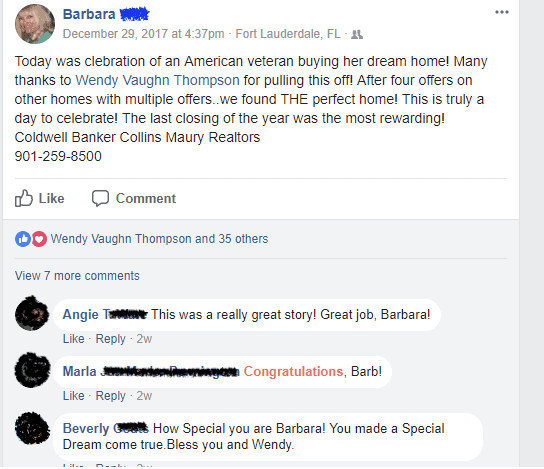

We recently had a mother and daughter come to us who were trying to buy a home.

And can I tell you, they were SERIOUSLY frustrated!

They tried to get a home for 6 months and had put in offers on 4 different houses. But none of them were accepted!

Seems hard to believe, right?

As we dug into their situation, we learned that their approval letter was from one of the big, online lenders. After talking to their realtor, the problem was that in each case, the sellers didn’t trust their prequalification. That’s why no one would accept their offer!

Getting a VA Loan Locally Puts This Family In a Home

These borrowers had not 1, but 2 qualifications for a VA loan. The daughter was a recent veteran of the military, and the Mother had received her certificate of eligibility (CA) from her deceased husband.

Many people don’t realize that VA eligibility can be transferred within the family, and that neither VA borrowers on the same loan need be married!

Our team had them approved for a loan within days of applying, and what do you know, their FIRST OFFER was accepted when they went house shopping once again.

That’s what we call “Offer with Confidence”.

Local real estate professionals trust a pre-approval letter from someone they know. That’s when they advise their clients to accept the SOLID offer… the one from our team.

You can get everything the online lenders promise from us, locally!