Finding the best VA loan can be stressful with a credit score of 680 to 710. You know your score is decent, but can you actually get a really low loan rate in this credit range?

The problem?

Other lending sites won’t show you any sample quotes!

… they only want your personal info!

Not at the Wendy Thompson Team. We’ll show you exactly what you want… sample VA loan rates.

We understand the process can feel overwhelming, but we will alleviate many of those fears and questions in this article as we explain how you can get the best VA loan rates with a 680, 685, 690, 695, 700, 705 to 710 credit score.

Within this article we will review the best VA loan rates by credit score, explain how your credit score can affect your VA mortgage interest rate, and options you may have available to increase your credit score.

Best VA Loan Rates with 680 to 689 Credit Score

As you can see in the below VA mortgage rates by credit score chart, the APR (Annual Percentage Rate) for people with a 680, 685 to 689 credit score start around 3.25%.

That is a great fixed rate to lock in for 30 years!

Keep in mind, these rates in this chart are for based on a $250,000.00 VA home loan and interest rates fluctuate almost daily.

Be sure to check with the Wendy Thompson Lending Team to receive a direct quote based on your circumstances.

| Fico score | APR | Mo. Payment |

|---|---|---|

|

760 – 850 |

2.75 % |

$1,021.00 |

|

700 – 759 |

2.75 % |

$1,021.00 |

|

680 – 699 |

2.75 % |

$1,021.00 |

|

660 – 679 |

2.875 % |

$1,038.00 |

|

640 – 659 |

3.0 % |

$1,055.00 |

|

620 – 639 |

3.25 % |

$1,089.00 |

*Updated 6/1/21 – Rates are based on a $250,000 loan with a 0% down payment and a 30 year VA mortgage. Rates change often and differ based on your state, down payment, length of loan, and loan amount.

Keep in mind that rates constantly change so it is best to contact us directly for the correct rate.

Take a look at some of the best VA loan rates for people with credit scores of 760, 775, 800, 825 or higher.

This is important because by raising your credit score just a tad bit you could save as much as forty or fifty thousand dollars in interest over a 30 year mortgage.

We will discuss some ways that you could possibly increase your 680, 684 or 688 credit score later in this article.

Learn More – Veterans Who Don’t Shop Around Pay Higher VA Mortgage Rates!

Best VA Loan Rates with 690 to 699 Credit Score

The average credit score for a VA home mortgage is right around 690 to 699.

VA loan lenders use your credit score to help determine the APR rate you will qualify for.

In addition to your credit score they will also consider the following:

- Debt-to-income ratio – this is the amount of money you have to pay every month for your bills as compared to your monthly income. VA lenders like to keep the debt to income ratio around 40%.

- Employment history – Va mortgage lenders like to see an employment history of at least 2 years. Generally, if you have been employed for 2 years or they look at your employment history as stable.

If you have a credit score of 690, 693, or 697 with a solid debt to income ratio and a history of employment over 2 years; than you can expect to receive the best VA loan rates for your credit score tier.

However, by increasing your credit score by only 10 points to 700, you may qualify for the next tier of better APR interest rates.

Improving your credit score can be tricky, be sure to discuss the best way to do so with the Wendy Thompson Lending Team.

In general, Vets looking to put no money down or do a cash-out refinance to 100% of the home’s value, will find the VA Mortgage the best option. But when the veteran doesn’t need 100% financing and they have a credit score of 680 or greater, than other financing options can become superior options.

Casey Lown, Mortgage Advisor

Best VA Loan Rates with 700 to 710 Credit Score

As you can tell from the chart above, the best VA loan rates by credit score are grouped by tiers.

When you have a lower credit score such as 601 or 622, the APR VA mortgage interest rate is much higher than if you have a credit score of 700, 705 or 710.

It is important to notice the higher your credit score gets past 701, your APR rate doesn’t go down that much more.

However, even a few tenths of a percentage point lower over the life of a 30-year VA mortgage can result in tens of thousands of dollars in savings.

Be sure to keep this in mind when discussing with your VA loan lender as there may be opportunities for you to buy down to a lower interest rate with a credit score of 702, 706 to 711.

| Fico score | APR | Mo. Payment |

|---|---|---|

|

760 – 850 |

2.75 % |

$817.00 |

|

700 – 759 |

2.75 % |

$817.00 |

|

680 – 699 |

2.75 % |

$817.00 |

|

660 – 679 |

2.875 % |

$830.00 |

|

640 – 659 |

3.0 % |

$844.00 |

|

620 – 639 |

3.25 % |

$871.00 |

*Updated 6/1/21 – Rates are based on a $250,000 loan with a 20% down payment and a 30 year VA mortgage. Rates change often and differ based on your state, down payment, length of loan, and loan amount.

Keep in mind that rates constantly change so it is best to contact us directly for the correct rate.

why choose the wendy thompson team?

There’s a lot that can go wrong if you use a rookie mortgage broker or one who doesn’t specialize in VA loans.

We’ve seen our military get burned by going to a competitor who promised a lower rate, but couldn’t get it approved.

At the Wendy Thompson Team, we’ve been doing VA loans for years and will not only save you time and money, but also help you get approved with credit problems and get you closed on time!

Can I Improve My Credit Score?

Yes!

Improving your credit score a few points can usually be done quickly.

Most people have never had a professional perform an analysis on their financial records, debt to income ratios or your credit reports.

Generally, when the Wendy Thompson Lending Team looks through your records, they will find a few glaring areas that can either be corrected or adjusted to benefit your credit score.

In some cases, there are huge mistakes on your credit reports and by disputing these mistakes, a much larger positive credit score adjustment can be seen.

Because the VA loan program does not require a down payment, in some instances if you have some savings, it makes more sense to pay down debt such as credit cards and auto loans to significantly lower your debt to income ratio.

All of these ideas, individually or in conjunction, can help you get the Best VA Loan Rates with 680 to 710 Credit Score.

Choosing a Preferred Lender: Is It Right for You?

Deciding on a preferred lender depends on you. Preferred lenders have ties to real estate pros, which can mean smoother processes and perks. But consider these:

Advantages:

- They know the real estate process.

- You may get special perks.

- If a trusted pro recommends them, it can boost your confidence.

Considerations:

- Compare their rates and terms with others.

- Don’t hesitate to negotiate.

- Make sure they’re impartial.

- Ask for all the details.

- Know your creditworthiness.

Your choice should match your financial goals. Compare, ask questions, and negotiate for the best deal.

How Preferred Lenders Handle Closing Costs

Preferred lenders often work with industry pros, offering these benefits:

- Lower closing costs.

- Slightly lower interest rates.

- Exclusive financing options.

- Faster approval.

Industry pros must be transparent about their ties to preferred lenders and any perks involved. But you have the final say. Compare offers, negotiate, and consider your financial goals. Fair and ethical practices are a must in these deals.

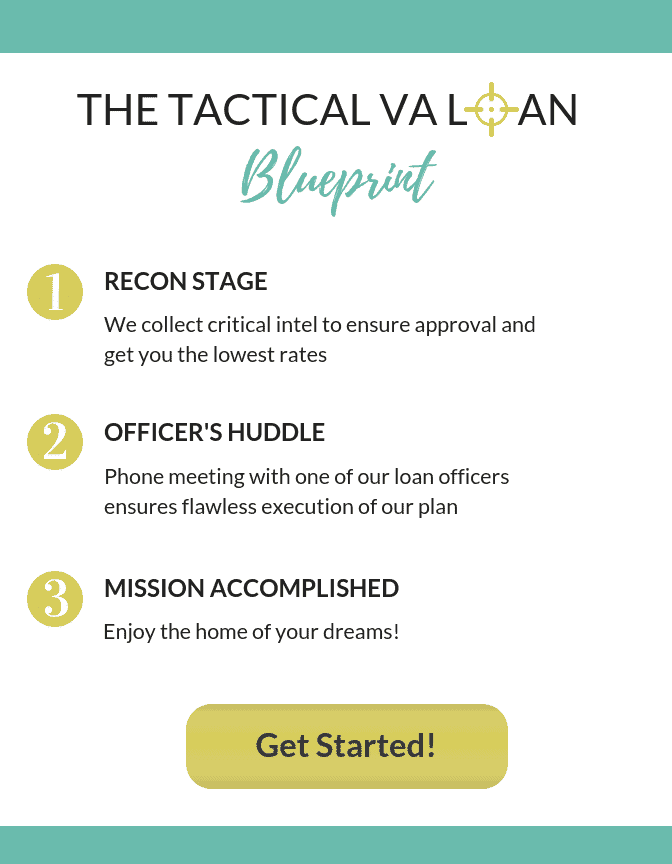

approval is easy with our “tactical va loan blueprint”

If you’re a current or retired military member looking to buy a home and choose to take advantage of the VA Loan program, you may be wondering the best mortgage company to go with.

Be very careful here as any mortgage company can offer a VA loan, but few of them specialize in VA loans, and there are a lot of ways lenders can screw up your dream of owning a home.

The Wendy Thompson Lending Team is one of the top ranked VA Loan and Mortgage specialist working with active military and veterans in all of the 50 States.

Unique only to the Wendy Thompson Lending Team is our easy 3 step plan:

Deciding on the right VA lender is the most important decision you will make. Choosing the wrong lender can result in you losing your dream home or costing you hundreds of thousands of dollars in more interest over the life of your mortgage.

Don’t make that mistake, contact the Wendy Thompson Lending Team today!

You can start the process by clicking the yellow ‘See if I’m Eligible’ button on the right side bar under the ‘Start your quote for VA Home Loan’ or call Wendy’s Team directly at (901) 250-2294, to get started on living the American Dream in the home of your Dreams!