Buying a home is stressful enough, let alone trying to find a mortgage when your credit score is 630 or less.

To make matters worse, most VA lenders won’t give you ballpark rates!

(They all want your personal info)

Not here!

In this article, you can get sample VA rates and monthly payments based on your credit score from 600 to 605, 610, 620, 625, and 630.

We’ll also discuss practical tips on how to increase your credit score quickly and how this can greatly benefit your pocket book.

Note: VA loan rates vary greatly based on your state, down payment, and credit score. Our recommendation for the most personalized, accurate quote is to start with your state.

Best VA Loan Rates for 600 To 609 Credit Score

While the Veterans Affairs office does not require a high credit score to qualify for a VA mortgage, generally, a lower credit score like 600, 605 or even 609, will not give you very many options.

This doesn’t mean you will not be approved. It just means that your loan lender will look at additional factors.

Let’s look at some sample quotes:

sample VA loan Rates by Credit score: 600 to 609

| Fico score | APR | Mo. Payment |

|---|---|---|

|

760 – 850 |

2.75 % |

$1,021.00 |

|

700 – 759 |

2.75 % |

$1,021.00 |

|

680 – 699 |

2.75 % |

$1,021.00 |

|

660 – 679 |

2.875 % |

$1,038.00 |

|

640 – 659 |

3.0 % |

$1,055.00 |

|

620 – 639 |

3.25 % |

$1,089.00 |

*Updated 6/1/21 – Rates are based on a $250,000 loan with a 0% down payment and a 30 year VA mortgage. Rates change often and differ based on your state, down payment, length of loan, and loan amount.

Keep in mind that rates constantly change so it is best to contact us directly for the correct rate.

Or click here to check your credit score for free. (Soft pull)

Remember, lenders look closely at important lending indicators like your debt-to-income ratio.

People with credit scores in the 600, 605 to 609 range statistically are more likely to default on their mortgage.

One tool the lenders use is how much money you earn compared to how much money you spend on a monthly basis.

VA home loans tend to have a higher debt-to-income ratio, usually, close to the 40% margin.

This means that your monthly mortgage (and other debt payments) should cost no more than 40% of your monthly take-home income.

Casey Lown

Mortgage Advisor

“Even down to a 580 FICO score, I will always present any financing opportunity that can be immediately available to the Veteran. However, I also like to educate them about how their financing opportunities can expand and terms improve when their credit scores improve to 620, 640, 660 and so forth. I encourage them to make certain adjustments to their credit card balances or other financial tweaks that could provide quick improvements to their credit score.”

Best VA Loan Rates for 610 To 619 Credit Score

VA loan interest rates for a credit score of 610, 615 to 619 will normally have a higher APR rate than higher credit scores.

The APR rate, or, Annual Percentage Rate, is the amount of interest you will pay over the life of your loan.

This is important because just a 0.50% higher APR will result in you paying tens of thousands of dollars more for your mortgage.

Credit scores in the 610 range will qualify for VA loans with higher APR’s, but no higher than the rates we saw in the 600 to 609 section.

Let’s take a look at those sample rates again.

sample VA loan Rates by Credit score: 610 to 619

| Fico score | APR | Mo. Payment |

|---|---|---|

|

760 – 850 |

2.75 % |

$817.00 |

|

700 – 759 |

2.75 % |

$817.00 |

|

680 – 699 |

2.75 % |

$817.00 |

|

660 – 679 |

2.875 % |

$830.00 |

|

640 – 659 |

3.0 % |

$844.00 |

|

620 – 639 |

3.25 % |

$871.00 |

*Updated 6/1/21 – Rates are based on a $250,000 loan with a 20% down payment and a 30 year VA mortgage. Rates change often and differ based on your state, down payment, length of loan, and loan amount.

Keep in mind that rates constantly change so it is best to contact us directly for the correct rate.

Or click here to check your credit score for free. (Soft pull)

Later in this article we will discuss how you can quickly increase your credit score and hopefully obtain a lower APR rate for your new mortgage.

Best VA Loan Rates for 620 TO 629 Credit Score

One positive about qualifying for a VA Loan is that there is no down payment required.

Even if you have a credit score of 620, 625 to 629, so long as you are active military, a veteran or a reservist, you should qualify for a VA mortgage.

This is something that you will want to discuss with the Wendy Thompson Lending Team as they will be able to explain all the benefits of obtaining a VA home loan.

For sample rates, see the section below:

Learn More – Veterans Who Don’t Shop Around Pay Higher VA Mortgage Rates!

Best VA Loan Rates for 630 TO 639 Credit Score

If you’re in the 630 to 639 range, you’re just on the cusp of getting better rates (many lenders offer better rates at a 640 credit score.)

Having said that, let’s look at some sample rates, along with things you can do to increase your credit score.

sample VA loan Rates by Credit score: 620 to 639

| Fico score | APR | Mo. Payment |

|---|---|---|

|

760 – 850 |

2.75 % |

$1,021.00 |

|

700 – 759 |

2.75 % |

$1,021.00 |

|

680 – 699 |

2.75 % |

$1,021.00 |

|

660 – 679 |

2.875 % |

$1,038.00 |

|

640 – 659 |

3.0 % |

$1,055.00 |

|

620 – 639 |

3.25 % |

$1,089.00 |

*Updated 6/1/21 – Rates are based on a $250,000 loan with a 0% down payment and a 30 year VA mortgage. Rates change often and differ based on your state, down payment, length of loan, and loan amount.

Keep in mind that rates constantly change so it is best to contact us directly for the correct rate.

Or click here to check your credit score for free. (Soft pull)

Let’s get back to your credit score now.

If you have a credit score in the 630, 635 to 639 range, there are probably a few factors that are affecting your credit score.

- Late Mortgage Payments

- No Credit History

- Chapter 7 Bankruptcy

- Chapter 13 Bankruptcy

- Collections and Federal Debts

- Foreclosure

Knowing these factors can affect your credit score now should help you make sounder decisions with your finances moving forward.

7 Steps To Quickly Increase Your Credit Score

Whether you have a credit score of 600, 605, 610, 615, 620 625, 630 or 635, you can still quickly increase your credit score so your lender can get you approved for a home loan and possibly a better interest rate.

The following seven steps can be taken to help increase your credit score:

- Check your credit reports – you can get a free copy of the three credit reporting agencies at AnnualCreditReport.com

- Dispute any inaccurate information in your credit report

- Payoff delinquent accounts

- Push down reported delinquencies with timely payments

- Reduce your debt-to-income ratio

- Don’t incur any new debt

- If you need help, you might hire a professional credit repair company

Following these simple seven steps can help to increase your credit score significantly.

Be sure to discuss your situation openly and honestly with the Wendy Thompson Lending Team because they will be able to help you prioritize what will have the biggest positive impact on your credit score.

Take Action!

If you’re a current or retired military member looking to buy a home and choose to take advantage of the VA Loan program, you may be wondering the best mortgage company to go with.

Be very careful here as any mortgage company can offer a VA loan, but few of them specialize in VA loans, and there are a lot of ways lenders can screw up your dream of owning a home.

The Wendy Thompson Lending Team is one of the top ranked VA Loan and Mortgage specialists working with active military and veterans in all of the 50 States.

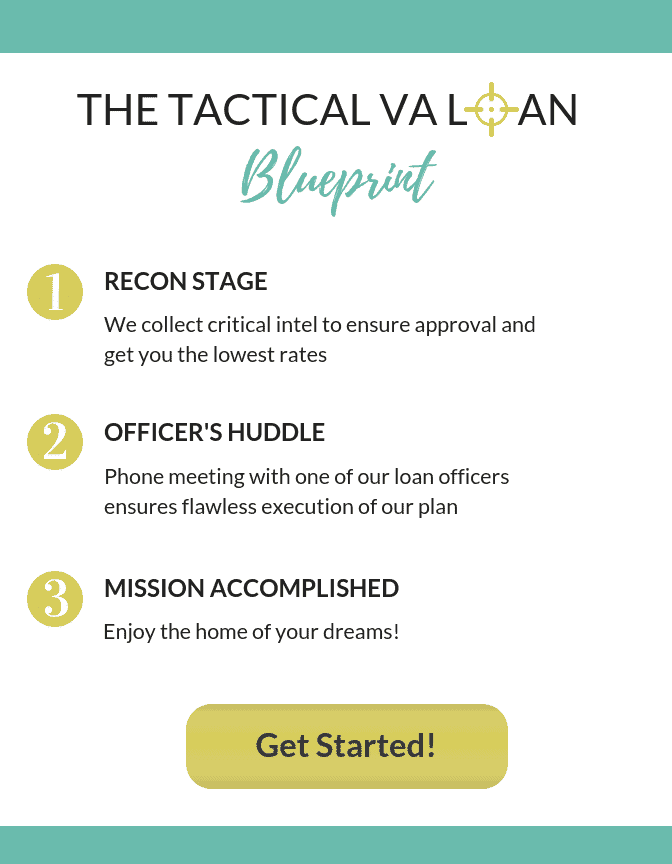

Unique only to the Wendy Thompson Lending Team is our Tactical VA Loan Blueprint!

See the simple 3 steps that take you from searching for your home to “mission accomplished.”

Deciding on the right VA lender is the most important decision you will make. Choosing the wrong lender can result in you losing your dream home or costing you hundreds of thousands of dollars in more interest over the life of your mortgage.

Understanding VA Refinance Rates

When considering a VA refinance, understanding current VA mortgage rates is crucial. These rates, like all mortgage rates, can fluctuate due to various factors. Here’s what you need to know:

- Market Conditions: VA refinance rates are influenced by daily market conditions, including economic factors such as inflation, employment rates, and government policies. Keep an eye on these indicators for insights into rate changes.

- Loan Type: Different VA refinance options (e.g., VA streamline refinance, cash-out refinance) may have slightly different rate structures, so it’s essential to explore your options.

- Credit Score: Your credit score plays a significant role in determining the interest rate you’ll qualify for. Higher credit scores often result in lower rates.

- 4. Loan Term: The length of your refinance loan term can impact the rate. Shorter-term loans typically come with lower interest rates compared to longer-term ones.

- Choice of Lender: Different lenders may offer slightly different rates and fees. It’s wise to compare offers from multiple lenders to find the best rate for your financial situation.

- Economic Factors: Broader economic trends and global events, such as changes in government policies, can also influence mortgage rates. Stay informed about these factors.

To get accurate, up-to-date VA refinance rates, reach out to multiple lenders and request rate quotes based on your specific financial situation and the type of refinance you’re interested in. Lenders can provide personalized rate information tailored to your credit score, loan amount, and other factors. Additionally, monitor financial news and economic indicators to gauge the overall direction of mortgage rates in the market.

VA Interest Rate Reduction Refinance Loan (IRRRL)

The VA Interest Rate Reduction Refinance Loan (IRRRL), commonly known as the VA Streamline Refinance, offers significant benefits for eligible veterans and active-duty service members with existing VA home loans. Here’s a closer look at this program:

Key Features and Benefits:

- Simplified Process: The VA IRRRL is known for its simplicity. It typically involves less paperwork and documentation than a traditional refinance, making it quicker and more straightforward.

- No Appraisal Required: In many cases, you won’t need a property appraisal, saving time and costs. The focus is on reducing the interest rate, not property value.

- Lower Interest Rates: The primary goal of the IRRRL is securing a lower interest rate than your current VA loan, leading to reduced monthly payments.

- No Out-of-Pocket Costs: Closing costs can often be rolled into the new loan amount, reducing upfront expenses.

- No Cash-Out: The IRRRL is designed solely for rate reduction, not accessing home equity. For cash-out options, consider other VA loan programs.

- Existing VA Loan Requirement: To be eligible, you must have an existing VA home loan to refinance.

- Credit and Income Requirements: While more relaxed than traditional loans, lenders may still assess your creditworthiness.

- Occupancy Requirement: The property being refinanced must be your primary residence.

- Funding Fee: In most cases, a funding fee is required but is typically lower than other VA loan programs.

- Interest Rate Types: You can use the IRRRL to switch from an adjustable-rate mortgage to a fixed-rate mortgage or to refinance an existing fixed-rate mortgage for a lower rate.

The VA IRRRL is a valuable option for eligible veterans and service members looking to reduce monthly mortgage payments by securing a lower interest rate. It simplifies the refinancing process and offers several benefits. To get started, contact VA-approved lenders who can guide you through the application process.

VA Streamline Refinance Rates

VA Streamline Refinance rates, also known as the Interest Rate Reduction Refinance Loan (IRRRL), can vary based on several factors. Here’s what influences these rates:

- Market Conditions: Like all mortgage rates, VA Streamline Refinance rates are influenced by market conditions, including economic factors like inflation, employment data, and government policies.

- Credit Score: Your credit score plays a significant role in determining the interest rate you qualify for. Borrowers with higher credit scores usually receive more favorable rates.

- Loan Term: The length of your refinance loan term can impact the rate. Shorter-term loans often have lower interest rates.

- Choice of Lender: Different lenders may offer slightly different VA Streamline Refinance rates and terms. Comparing offers from multiple lenders is essential to finding the most competitive rate.

- Loan Amount: The loan amount may also affect the interest rate. Some lenders offer better rates for loans within specific ranges.

- Creditworthiness: Lenders may consider factors beyond your credit score, such as payment history, income stability, and debt-to-income ratio, when determining your rate.

- Property Type: The type of property being refinanced, whether a single-family home or condominium, can affect the rate.

For the most accurate and up-to-date VA Streamline Refinance rates, contact multiple VA-approved lenders and request rate quotes based on your specific financial situation. Lenders can provide personalized rate information tailored to your credit profile, loan amount, and other factors. Keep in mind that rates can change daily, so monitor them closely and lock in a rate that aligns with your refinancing goals.

Choosing a Preferred Lender: Is It Right for You?

Deciding on a preferred lender depends on you. Preferred lenders have ties to real estate pros, which can mean smoother processes and perks. But consider these:

Advantages:

- They know the real estate process.

- You may get special perks.

- If a trusted pro recommends them, it can boost your confidence.

Considerations:

- Compare their rates and terms with others.

- Don’t hesitate to negotiate.

- Make sure they’re impartial.

- Ask for all the details.

- Know your creditworthiness.

Your choice should match your financial goals. Compare, ask questions, and negotiate for the best deal.

How Preferred Lenders Handle Closing Costs

Preferred lenders often work with industry pros, offering these benefits:

- Lower closing costs.

- Slightly lower interest rates.

- Exclusive financing options.

- Faster approval.

Industry pros must be transparent about their ties to preferred lenders and any perks involved. But you have the final say. Compare offers, negotiate, and consider your financial goals. Fair and ethical practices are a must in these deals.

You can start the process by clicking the yellow ‘See if I’m Eligible’ button on the right side bar under the ‘Start your quote for VA Home Loan’ or call Wendy’s Team directly at (901) 250-2294, to get started on living the American Dream in the home of your Dreams!