[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”4.16″ custom_padding=”7px|||||” global_colors_info=”{}”][et_pb_row admin_label=”row” _builder_version=”4.16″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.16″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_text admin_label=”Text” _builder_version=”4.16″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” global_colors_info=”{}”]

Buying your first home is thrilling! But it can also feel overwhelming — between finding the right home and the right financing, the process can make anyone’s head spin.

But veterans have a distinct advantage.

So, if you’re a veteran of the military, we have great news for you:

Your VA home loan benefit is one of the best ways to secure financing on your first home.

At the Wendy Thompson Lending Team, we love working with VA loan first-time buyers because of the amazing benefits we know they’ll get.

Here’s why you should consider a VA loan.

1. Flexible Guidelines for First-Time Homebuyer with VA loan

VA loans are one of the most accessible mortgage programs to qualify for — they have the most flexible underwriting guidelines out of any home loan option available.

Because the VA guarantees the loan, lenders can offer flexible guidelines without worrying about losing their investment if the borrower defaults.

And lenders pass that leeway on to you.

Even if you have blemished credit or a higher than average debt-to-income ratio, you may still meet VA loan eligibility requirements.

2. Credit Score VA Home Loan Requirements 2022

The VA doesn’t set specific credit score requirements. Instead, VA loan minimum credit scores are up to the lender to decide.

With the VA backing the loan, most lenders, like us here at the Wendy Thompson Team, can get VA mortgages for borrowers with less-than-perfect credit scores.

Here’s the thing:

This doesn’t mean you can have terrible credit and still qualify.

But we can work with you — even if you have credit blemishes — to get you approved. That’s because your credit score isn’t the only focus.

We look at the big picture for VA loan first-time buyers. Your credit is just one piece of the puzzle.

3. No Down Payment Required

Not needing a down payment is one of the best things about a VA loan — and it’s probably the most significant benefit when comparing a VA loan vs. conventional loan.

Conventional loans require at least 3% for first-time homebuyers, but a VA loan buyer doesn’t need a down payment at all.

This allows you to buy a home much sooner than if you had to wait to save up a significant down payment.

For example, suppose you found a $200,000 home. In that case, you’d need $6,000 minimum for a down payment (and that doesn’t include closing costs!).

Because VA loans don’t require a downpayment, becoming a first-time homebuyer with a VA loan is much more affordable.

4. Fixed Monthly Payments

VA loans offer fixed interest rates. Because your interest rate won’t fluctuate, neither will your monthly payments.

That’s one of the benefits of a VA loan vs. conventional — a conventional home loan could come with a variable interest rate.

Variable rates mean you may not know how much your mortgage payment will be from one year to the next.

And that can make it hard to budget and keep up with your mortgage payments. But a fixed-interest-rate VA loan makes homeownership simple.

Learn More – Veterans Who Don’t Shop Around Pay Higher VA Mortgage Rates!

5. Lower Interest Rates than Other Mortgages

Speaking of interest rates, VA loans can offer more competitive interest rates than other mortgage options.

And a lower interest rate has three significant benefits:

- Lowers monthly payments: A lower interest rate means you’re paying fewer fees, which drops your monthly payment amount.

- Easier to qualify: Lower monthly payments can give you a lower debt-to-income ratio, making it easier to qualify and get the best terms available.

- Saves you money: A lower interest rate means you’ll pay fewer fees to borrow the money — and that leaves more cash in your pocket over the life of the loan.

6. Fewer Closing Costs

When working with one of the best VA loan lenders, you get the lowest possible closing costs.

Because here’s the thing:

The VA has a cap on how much you pay in closing costs. And less money out of your pocket can make your dream of homeownership happen sooner.

Check Extra VA Rates

7. No Private Mortgage Insurance

If you look at other government-backed loans, like an FHA loan, you’ll see they charge for private mortgage insurance (PMI).

The same is true for conventional loans — you’ll pay PMI until you owe less than 80% of the home’s value.

But there’s good news:

VA loans don’t charge PMI.

You pay a one-time VA funding fee upfront, but that’s it. You’ll never pay monthly mortgage insurance.

This saves you even more money on your monthly payment and makes it easier to meet the VA home loan requirements in 2022.

VA Loan First-Time Buyers: Get Your Dream Home Today!

If you’re a first-time homebuyer, consider using a VA loan. A VA loan offers excellent advantages you won’t find in other home loan options.

After all, you worked hard to serve your country — you deserve affordable and flexible financing to buy your dream home.

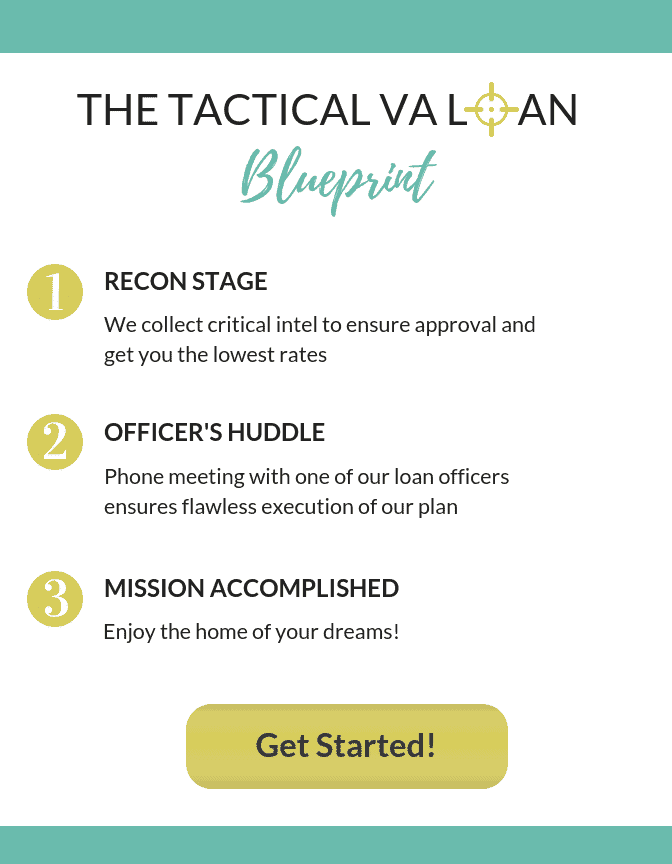

Contact the Wendy Thompson Team today to see how easy it is to pre-qualify for a VA loan.

Deciding on the right VA lender is the most important decision you will make. Choosing the wrong lender can result in you losing your dream home or costing you hundreds of thousands of dollars in more interest over the life of your mortgage.

Don’t make that mistake, contact the Wendy Thompson Lending Team today!

You can start the process by clicking the yellow ‘See if I’m Eligible’ button on the right side bar under the ‘Start your quote for a Home Loan’ or call Wendy’s Team directly at (901) 250-2294, to get started on living the American Dream in the home of your Dreams!

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]